ride to care mileage reimbursement

Financing through M T Bank. To view FAQs get forms and Mileage Reimbursement Trip Logs and file a complaint visit the Veyo website.

Doc Pdf Free Premium Templates Mileage Tracker Mileage Tracker Printable Mileage Log Printable

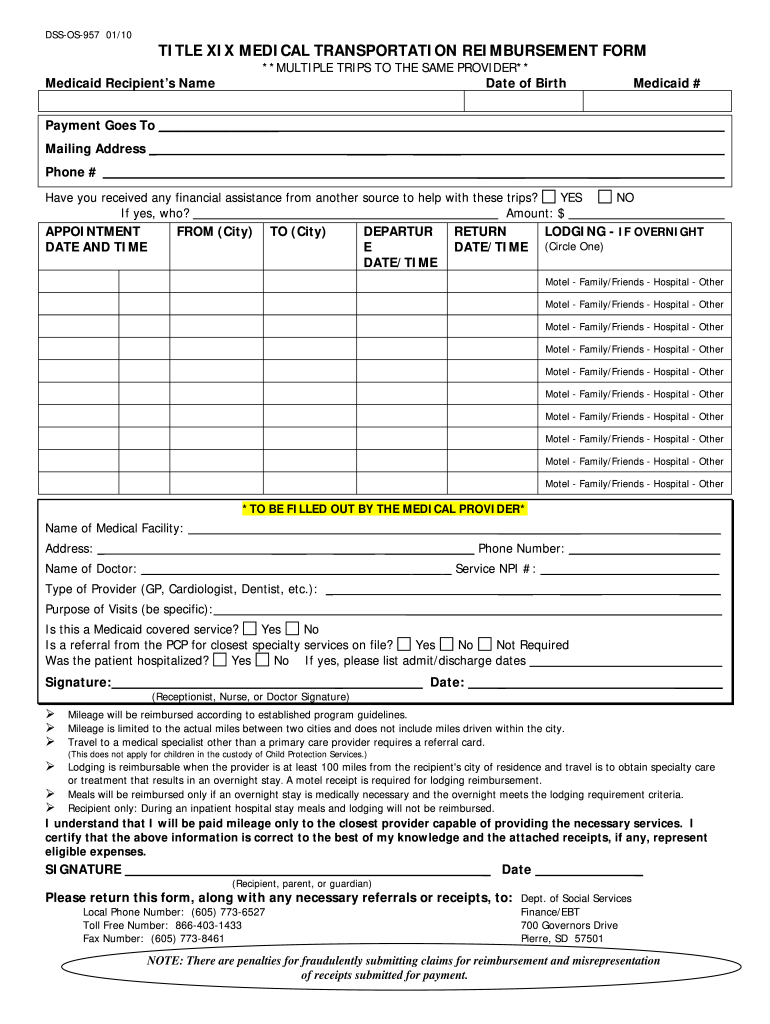

Mileage is reimbursable as long as a receipt statement or bill validating your doctor visit is submitted with your claim requesting mileage reimbursement.

. You will receive a mileage reimbursement check unless you use public transportation and choose to receive one bus pass instead. Medical and health care payments and crop insurance proceeds. If you are selected to serve on a jury you will be paid 12 per day which is set by law.

Join our network as an established transportation company. See the Instructions for Forms 1099-MISC and 1099-NEC for more information and additional reporting requirements. If your ride is 15.

For charges paid directly to Alaska Airlines during Web Check-In Kiosk Check-In or with an Alaska Airlines Agent please see an Alaska Airlines Airport Customer Service Agent for refund assistance or contact us. The rate for mileage reimbursement is set by law and the roundtrip distance is based on the mileage from the center of your zip code to the Court. To book manage and cancel trips online visit the Veyo member portal.

Find out where your scheduled ride is if it has not shown up Change a trip reservation Cancel a trip reservation File a complaint. Be sure to write down the confirmation number. For tax year 2020 the standard mileage rate for the cost of operating your car van.

Pre-Owned 2019 Dodge Grand Caravan SXT With the New Driverge FlexFlat 4 or Quiet Ride Conversion 17 Financing promotion require 20 down or trade or equivalent and 120 payments of 382 a month. You can schedule your ride by calling toll-free 877-404-4500 and TDD 800-722-0353 during these hours. Full and part time employment driver.

Receive mileage reimbursement to drive yourself of a family Friend or Neighbor medical appointments. A trip authorization number must be obtained in advance through the reservation line for gasmileage reimbursement. The standard mileage rate for use of an automobile to obtain medically necessary health care as described in IRS Code Section 213 is 016 for travel that takes place from 1121 through 123121 and 016.

Mileage Reimbursement -Modivcare provides mileage reimbursement to members or non-commercial drivers ie not a qualified transportation provider but such as a relative or family member who transport a member to his or her covered medical appointment. Mileage reimbursement will be paid at a specified rate per mile for each mile that the member is driven. File Form 1099-NEC Nonemployee Compensation for each person to whom.

View hotel car and ride reservations. Join our network and being reimbursed for driving as a volunteer driver. 499 APR Annual Percentage Rate for 120 months.

Receive mileage reimbursement to drive clients to approved medical appointments. Checked baggage upgrades paid or mileage unaccompanied minor service pet travel or therapeutic oxygen. Monthly payments are based on price above down payment and approved credit.

Medical Mileage Reimbursement A No Fault Insurance Benefit

Expense Claim Form Templates 7 Free Xlsx Docs Samples Templates Funny Awards Certificates Estimate Template

Truck Driver Trip Envelope Custom Printing Designsnprint Trucking Companies Truck Driver Trucking Business

Horse Carriage The Wynkoop Plans To Start Delivering Beer By Horse And Carriage Horses Ghost Tour Horse And Buggy

Medicaid Mileage Reimbursement Rate 2021 Fill Online Printable Fillable Blank Pdffiller

Mileage Reimbursement A Complete Guide Travelperk

The Irs Announces Standard Mileage Rates For 2018 The Optional Mileage Allowance For Owned Or Leased Vehicles Including Autos Van Vehicles Vehicle Tracking